|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

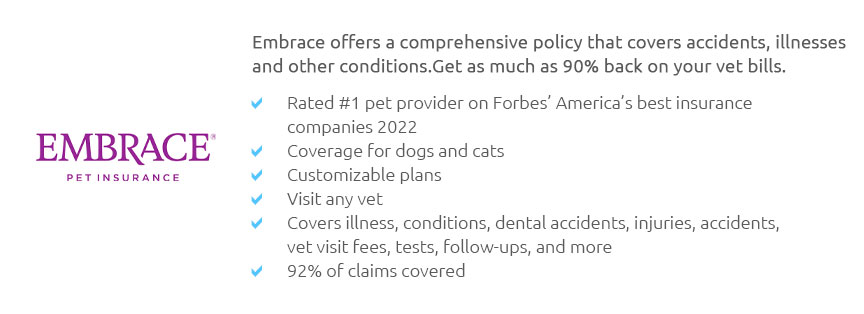

Exploring the Best Pet Insurance Options in HawaiiWhen living in the picturesque paradise of Hawaii, the well-being of our furry companions often takes center stage. As a pet owner, ensuring that your beloved animals are covered by the best insurance is not just a luxury; it’s a necessity. With a myriad of options available, choosing the right pet insurance can be a daunting task. This article delves into the most popular choices, offering insights into what makes each unique and worth considering. One of the standout options in the Hawaiian pet insurance landscape is Healthy Paws. Known for its comprehensive coverage and competitive pricing, Healthy Paws offers a single, straightforward plan that covers accidents, illnesses, cancer, emergency care, genetic conditions, and alternative care. The absence of caps on annual or lifetime payouts is a significant advantage, especially for those with pets prone to chronic conditions. However, one must weigh these benefits against the fact that they do not cover routine care or exam fees, which could be a deciding factor for some pet owners. Another notable contender is Embrace Pet Insurance. What sets Embrace apart is its customizable plans, allowing pet owners to tailor coverage to their specific needs. From accident-only policies to comprehensive plans that include wellness rewards for routine care, Embrace provides flexibility that is particularly appealing. The diminishing deductible feature, where your deductible decreases each year you don’t receive a claim reimbursement, is a unique incentive that might sway budget-conscious individuals. On the downside, Embrace’s reimbursement process can be lengthy, a factor worth considering for those who prioritize quick payouts. For those who prefer a provider with a broad network, Nationwide is a household name that extends its services to pets. Offering three distinct plans-Major Medical, Whole Pet with Wellness, and Pet Wellness-Nationwide provides options that cater to different levels of need. Their Whole Pet plan stands out for its extensive coverage, including prescription food and behavioral treatments, which is ideal for pet owners seeking comprehensive care. Despite its robust offerings, some may find Nationwide’s premium prices a bit steep, particularly when compared to other providers. Trupanion is another option that has garnered attention for its straightforward 90% coverage on eligible expenses without payout limits. Trupanion's unique selling point is its direct pay feature, which allows the insurer to pay your vet directly, thereby reducing out-of-pocket expenses. While this is advantageous, Trupanion’s lack of coverage for routine care and the requirement for a higher deductible could be potential drawbacks for some. In conclusion, choosing the best pet insurance in Hawaii requires a thorough assessment of your pet’s needs and your financial situation. Whether you value comprehensive coverage, customizable plans, or straightforward policies, the right insurance can provide peace of mind as you enjoy life with your four-legged friends in the Aloha State.

https://insurify.com/pet-insurance/best-pet-insurance-hawaii/

Spot, Embrace, and Paw Protect are a few of the best pet insurance companies in Hawaii. Learn more. https://www.uhahealth.com/news-events/blog/pet-insurance-with-pets-best

Learn how pets can positively affect your wellness! $40 will be donated to the Hawaiian Humane Society for each application submitted via ... https://www.yelp.com/search?find_desc=Pet+Insurance&find_loc=Honolulu%2C+HI

Top 10 Best Pet Insurance in Honolulu, HI - February 2025 - Yelp - VCA University Animal Hospital, Hawaii Pet Insurance, King Street Pet Hospital, ...

|